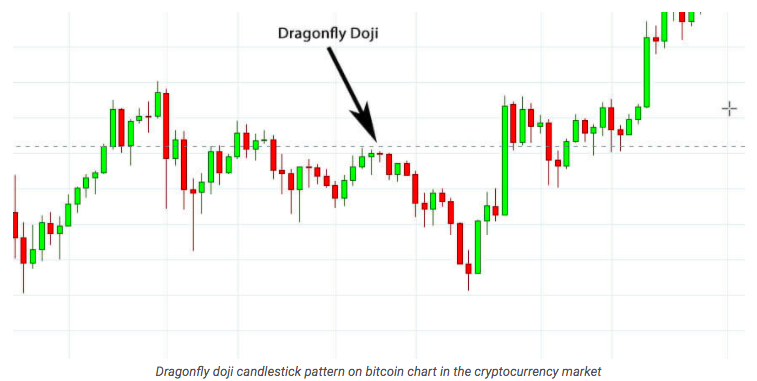

You’re looking at an image of the Doji Dragonfly candlestick pattern, which signals that the bulls and bears are locked in combat, and neither side has gained much ground in the past couple of sessions.

This could mean that price action over the next few bars will be extremely close to the previous candle’s high or low, and traders may struggle to find direction until something happens to shift the balance of power one way or another. Let’s take a look at what this pattern means and how you can use it in your own trading practice.

Introduction

A doji is a candlestick pattern that can signal indecision in the market. The doji is created when a security’s open and close prices are virtually equal. It shows an area where buyers were unable to push the price higher or sellers were unable to drive it lower.

Dojis usually form at the end of an extended trend because they signal either exhaustion among buyers or sellers, or some other reason for uncertainty like news events. There are two types of dojis- long and short- which are distinguished by their shadows. A long (or tall) doji has long shadows on both ends, while a short (or small) doji has short shadows on both ends.

What is a Doji Dragonfly Candlestick?

A Doji Dragonfly Candlestick is a two-candlestick pattern that can signify indecision in the market. The first candlestick is a doji and the second is a dragonfly Doji.

It is also called a Dragonfly Doji or an Inverted Hammer. This pattern has two parts – the first being a doji candle and the second being a dragonfly doji candle.

The candlestick pattern appears during a period of indecision in a trend. In other words, it forms during periods when market participants are unsure of where prices are going next.

Some traders will use these patterns to signal when to buy or sell because they can represent changes in momentum and key turning points in a trend. Others might wait for confirmation before making any trades because doji and dragonfly doji candles can be common reversal patterns that are often followed by periods of price retracement.

What Does a Doji Dragonfly Candlestick Mean?

A Doji Dragonfly Candlestick is a reversal pattern. This type of candlestick formation can be seen on price charts and is created when the open and close are almost equal.

A Doji Dragonfly Candlestick can take the form of one day or two days. It indicates that traders are undecided about which direction to go in.

A single Doji Dragonfly Candlestick means that there was an indecisive session on the market and often indicates a potential reversal in trend. The market could be moving too quickly for traders to keep up with it so they don’t know what to do next.

The Doji Dragonfly can also be seen in other forms of technical analysis. A single day Doji can indicate a potential reversal. While it’s an unreliable indicator by itself, it’s commonly used as a reversal formation when other indicators are present.

It can also form part of another candlestick pattern like Three Black Crows or Harami Cross.

The chart below shows examples of both a single day and two day Doji Dragonflies that were followed by lower prices for BTC/USD over several days. There are more examples above so check them out to get a better understanding for yourself!

Examples of Dragonfly Doji

A Dragonfly Doji is a complex reversal pattern that looks like two consecutive long shadows with small bodies. It can be interpreted as either a bullish or bearish signal depending on what preceded it.

The Dragonfly Doji is sometimes called the Bullish Doji. The Bullish Dragonfly Doji signifies that the sellers are exhausted and the buyers are taking control of the market. A Bullish Dragonfly often occurs after a downtrend and before an uptrend.

The Bearish Dragonfly Doji signifies that sellers are becoming more aggressive, causing prices to trend downward. Typically this pattern will occur after an uptrend and before a downtrend takes place. A Bearish Dragonfly Doji in conjunction with a Shooting Star indicates that sellers are aggressively pushing down prices.

Dragonfly Doji vs. Gravestone Doji

Dragonfly doji signals exhaustion in a bull market and is also called a hammer or inverted hammer. It’s created when the open and close are at or near the same level.

When dragonfly dojis form after an uptrend, it can signal exhaustion of buyers. When they form after a downtrend, it can signal exhaustion of sellers. A gravestone doji indicates indecision in a bear market because it’s created when the open and close are at opposite levels.

If a dragonfly doji forms after an uptrend and then prices resume falling, that’s a good signal that bulls have exhausted themselves in their rally.

Likewise, if it forms after a downtrend resumes and prices then continue lower, that also indicates exhaustion of sellers in their downtrend. A gravestone doji is different because it signals indecision at market extremes; it’s created when prices gap between open and close (typically down).

Limitations of Using the Dragonfly Doji

The dragonfly doji is a minor pattern that can be used to signal a reversal in trend or that the price is consolidating. It’s important to note that it does not signal the completion of the trend reversal, nor does it signal the start of a new trend. This means that you may want to wait for confirmation before entering into an opposite trade.

For example, if you’re looking at a dragonfly doji and also see higher highs and higher lows on shorter time frames, then you may want to enter into an opposite trade.

Conversely, if there are no higher highs or higher lows on shorter timeframes following the dragonfly doji candle close then you may want to wait for more confirmation before entering into an opposite trade.

The final limitation of using dragonfly dojis is that they can be easy to mistake as an indecisive or neutral candle. If you see a long-legged doji then you will want to confirm there wasn’t a higher low or lower high on previous candles that would indicate an indecisive session.

Additionally, if you see an extremely long candlestick right before or after the dragonfly doji then it could influence whether it’s a true bullish reversal pattern or not.

While both of these scenarios aren’t ideal to seeing a reversal in trend from a dragon fly doji pattern (i.e. no confirmation), they are more common than mistakenly reading a false bullish reversal and missing out on potential trading gains.

Explore the world of Doji Dragonfly candlesticks through a helpful video. Although not our creation, this video breaks down the essentials. Learn about their meanings, uses, and see real examples that make the concept clearer.

This video, combined with our blog, gives you a well-rounded understanding of this candlestick pattern. Get ready to make smarter trading decisions as you dive into the world of finance. Check out the video to truly grasp Doji Dragonfly candlesticks.

Conclusion

A doji dragonfly is a neutral pattern that does not show a clear trend. It’s also one of the best ways to spot a trend reversal or correction. In other words, if you see a doji dragonfly on your chart after the stock has been trending up for an extended period of time, it could be time to consider selling your shares. The opposite is true if you see it after the stock has been trending down.

The doji dragonfly is an uncommon pattern with a very clear meaning. Because of that, you’re unlikely to see one on any stock charts that you look at every day.

Even so, it’s worth knowing what they are and how they appear. If you don’t see one on a chart soon, it’s likely that your next dragonfly sighting will be long in coming. Until then, keep watching for opportunities!