Scalping has gotten some bad press over the years, but it isn’t as unsavory as most people assume. In fact, if you’re looking to make quick profits with smaller amounts of money, scalping can be a great way to do it. Here are some basic tips for getting started scalping and making money without having to wait around for huge returns.

What Is Scalping?

Scalping is an investing and trading strategy that seeks to capitalize on small, short-term price changes in the market. It involves taking advantage of the difference between the bid and ask prices for a security, commodity, or currency. This strategy is often used by traders who are looking to make quick profits without holding positions for long periods of time.

When scalping, traders usually set tight stop-loss orders, which allow them to exit their trades quickly if the market moves against them. This helps to minimize losses and increase the chances of making a profit. Traders also look for high liquidity markets, which offer low transaction costs, tight spreads, and fast execution.

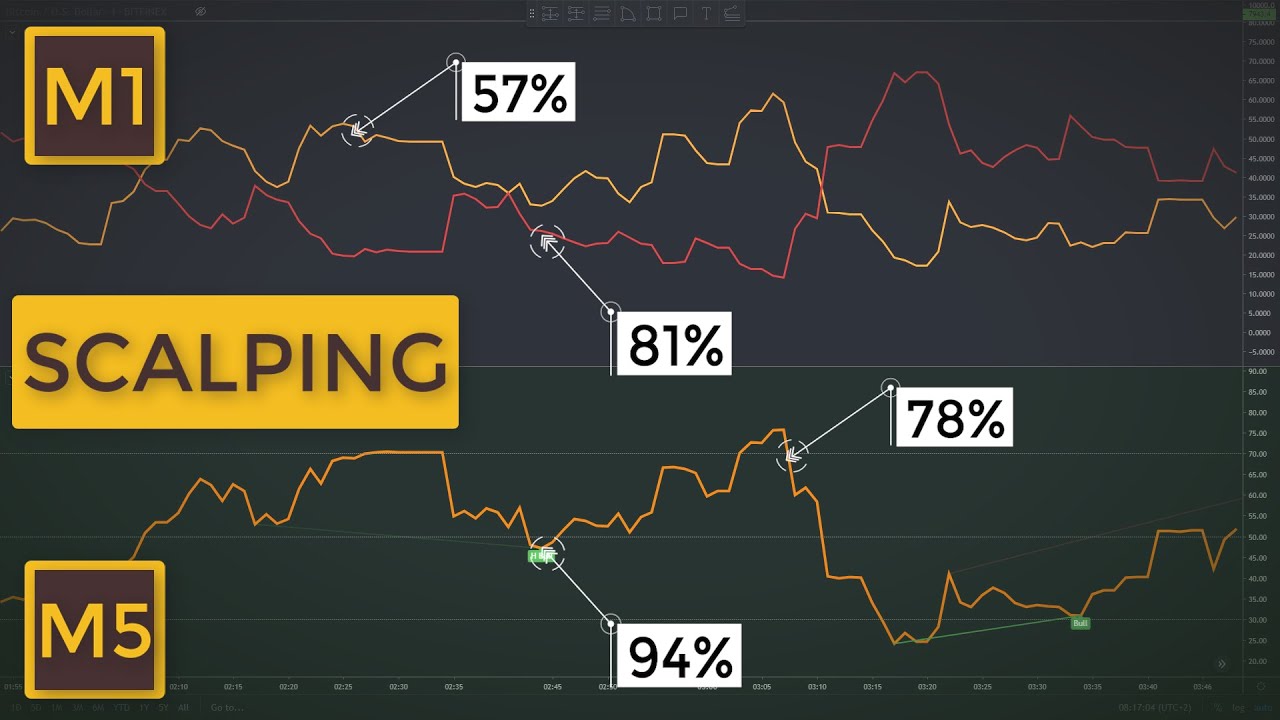

Scalpers may employ technical analysis techniques like chart patterns or momentum indicators to identify good entry and exit points. They can also use automated trading systems that employ algorithms to generate trade signals and execute orders automatically.

To maximize profits, scalpers need to be patient and disciplined. They must be willing to take small profits instead of waiting for larger returns that may never materialize. While scalping may not be as profitable as other longer-term strategies, it can still provide quick profits that add up over time.

By employing scalping techniques, traders are able to capitalize on short-term price fluctuations that can occur in the market. It’s important to note that scalping is not suitable for every trader and should only be used by those who are willing to take small losses in order to maximize profits.

Traders should also keep an eye on their risk levels and be prepared to exit quickly if the market moves against them. With the right strategy, scalpers can benefit from quick profits that add up over time.

Why Would You Want to scalp?

Scalping is a popular trading strategy among traders looking to make quick profits on the markets. It involves making numerous small trades in an effort to take advantage of small price movements. This strategy can be extremely profitable if done correctly, as small profits add up quickly over time.

One of the primary benefits of scalping is that it allows traders to take advantage of fast-moving markets. By opening and closing trades quickly, traders can capitalize on small price movements that would be too small to make any meaningful profits from in traditional buy and hold strategies. Furthermore, scalping also allows traders to limit their risk exposure. By trading only when there is an opportunity to make a profit, traders can keep their losses to a minimum.

Another benefit of scalping is that it allows traders to take advantage of market opportunities without having to dedicate large amounts of capital. Since the trades are typically opened and closed very quickly, traders do not need to worry about large amounts of capital being tied up in the markets for extended periods of time.

This makes scalping an attractive strategy for those who may not have large amounts of capital to invest but still want to capitalize on market opportunities.

Overall, scalping can be an extremely profitable trading strategy, as long as it is done correctly. By taking advantage of fast-moving markets and limiting risk exposure, traders can make quick profits without having to devote large amounts of capital. With the right strategy in place, scalping can be a great way to add up small profits and make a big payoff over time.

Scalping can be profitable for experienced traders, but it is important to remember that there are risks associated with any kind of trading. It is important that traders have a thorough understanding of the markets and use risk management techniques in order to limit their exposure.

Furthermore, scalpers should always maintain a disciplined approach and be aware of the current market conditions in order to take advantage of opportunities while minimizing risk.

The Risks of Scalping

When it comes to investing, there is always a risk involved. Scalping is no exception, as it carries its own set of risks that need to be weighed before deciding if it’s the right strategy for you.

Scalping involves taking quick profits from small price movements. As such, the main risk associated with scalping is the potential for losses due to the fast-paced nature of the strategy. This means that even if you’re following a good trading system, there’s still a chance that your trades will end up in losses due to external factors.

In addition, scalping requires a high degree of discipline. You must be able to stick to your plan and take action quickly when opportunities arise. This means you must be comfortable with making decisions in a very short time frame. If you don’t have the ability to make split-second decisions or are easily swayed by emotion, scalping may not be the best strategy for you.

Finally, scalping can be very stressful. Since you’re dealing with such small profit margins and tight timeframes, any unexpected events or movements in the markets can lead to substantial losses if you’re not prepared. As such, it’s important to have an effective stress management strategy in place so that you can make rational decisions even under pressure.

It’s important to remember that scalping is not suitable for everyone and carries risks of its own. Before starting a scalping strategy, it’s important to weigh all of the risks and rewards associated with it so that you can make an informed decision about whether it’s right for you.

However, if you’re comfortable with the risks associated with scalping and have the necessary discipline and mindset, it can be an effective strategy for generating quick profits. With practice and dedication, scalpers can learn how to spot opportunities and act quickly on them, allowing them to capitalize on the small fluctuations in the market and generate consistent profits over time.

Is Scalping Worth It?

When it comes to investing, everyone wants to get the most bang for their buck. But is scalping worth it? Scalping is a form of trading that involves taking small, quick profits off of a stock or commodity. By focusing on small trades, scalpers can avoid taking large losses if the market moves against them.

At first glance, scalping may not seem like a great way to make money since the profits are so small. However, these small profits can add up over time. If you are able to find stocks with small but consistent gains, the profit margins can start to add up quickly.

Additionally, since scalping focuses on small trades, it can be easier to identify profitable opportunities in the market without taking too much risk.

In order to be successful at scalping, however, it’s important to understand the markets and know how to identify patterns and potential opportunities. You’ll also need to have a plan for each trade and know when to take profits and cut losses. Trading too aggressively can quickly turn a profit into a loss, so it’s important to keep your emotions in check and stay disciplined.

Ultimately, scalping can be a great way to make money if done correctly. With patience, discipline, and knowledge of the markets, scalpers can take advantage of small gains and build up significant profits over time.

While scalping may not be suitable for everyone, it can be an effective way to trade in the markets. It’s important to understand the risks involved and make sure you are comfortable with the strategy before you start trading.

It’s also important to have the right tools and resources available so you can identify potential opportunities and keep track of your trades. With the right resources and knowledge, scalping can be a great way to take advantage of small gains in the markets and turn them into larger profits.

Must watch these video if you are knowing more about scalping trading strategy:

Conclusion

In conclusion, scalping can be a great way to make quick profits in the stock market. By taking small positions and making quick profits, you can add up your gains to make a big payoff over time. The key is to have the patience and discipline to stick with it and keep adding those small gains. With practice and focus, scalping can be an effective way to get ahead in the stock market.

Remember, scalping is not a one-time strategy that you can set and forget. You need to actively monitor your positions and look for opportunities in the market. By being diligent and patient, you can start adding up small gains until you have a sizable profit from scalping. With the right approach, scalping can be an effective way to take advantage of the stock market’s ever-changing landscape.