If you’re going to invest in stocks, it pays to know how to pick them for the long term. Researching and analyzing companies takes time, so you’ll want to make sure that the investment you choose has a good chance of outperforming the market over the long haul—which means picking the right stocks and not just buying at the peak of an economic bubble.

Here are some strategies to help you pick stocks for the long term rather than focus on short-term gains. You may be wondering, how do I pick stocks for the long term?

If you’re not an expert stock picker, the answer can seem like a daunting prospect. After all, there are an endless number of stocks to choose from – and you probably don’t want to make any mistakes as you’re getting started.

Fortunately, it’s not all that hard to find undervalued stocks that you can hold on to over the long term (after all, people have been doing this for decades). Here’s how to pick stocks for the long term.

Focus on the Fundamentals

When it comes to picking stocks for the long-term, it’s important to focus on the fundamentals. Analyzing the fundamentals of a company gives investors insight into its financial health, competitive edge, growth potential, and the industry in which it operates.

Before investing in any stock, it’s essential to look at the company’s financial statements, such as income statement, balance sheet, and cash flow statement. It’s also important to research the company’s management and competitors. This will provide you with a better understanding of the company’s strengths and weaknesses.

In addition to financial analysis, you should also consider other factors such as the industry outlook and the macroeconomic environment. Are there any emerging technologies that could disrupt or benefit the industry? What are the economic conditions like in the country or region where the company operates? These are all important questions to ask yourself when picking stocks for the long term.

Ultimately, it is important to focus on the fundamentals when selecting stocks for the long term. By analyzing the company’s financial statements and researching its industry, management, and competitors, you can make informed decisions about which stocks to invest in for maximum returns.

Dividend Consistency

When considering stocks for the long term, one of the most important factors to consider is dividend consistency. Dividend consistency refers to a company’s ability to pay dividends to shareholders on a consistent basis. Companies that have a history of paying consistent dividends are more likely to continue to do so in the future, making them more attractive investments for long-term growth.

When looking at a company’s dividend consistency, it’s important to consider both the length and amount of the dividend payments. Look for companies that have been paying dividends consistently over a long period of time, as this is an indication that they are financially stable and will likely continue to pay dividends in the future.

Additionally, it can be beneficial to focus on companies that have steadily increasing their dividend amounts as well. A company that has increased their dividend payout in the past is more likely to continue doing so, which can lead to larger gains for investors in the long run.

It’s also important to keep an eye out for special dividends, which are one-time dividend payments that may not be repeated in the future. Special dividends should not be relied upon when considering a stock for long-term investments, but they can still be a nice bonus if you happen to come across one.

In summary, dividend consistency is an important factor when selecting stocks for the long-term. Look for companies with a long history of consistent dividend payments, especially those that have increased their dividend payout in the past.

Be aware of special dividends, but don’t rely on them as part of your long-term strategy. With this knowledge, you can be sure that you’re picking stocks that will continue to pay out dividends into the future.

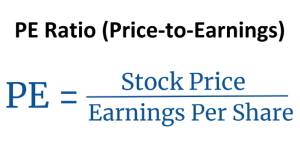

Examine the P/E Ratio

When looking at stocks for the long-term, it’s important to examine the price-to-earnings (P/E) ratio. This number is calculated by taking the company’s share price and dividing it by its earnings per share. By looking at the P/E ratio, you can gain insight into the company’s growth potential, as well as its current market value.

A company’s P/E ratio can vary depending on the sector and industry in which it operates. Generally speaking, higher P/E ratios suggest that a company is more highly valued than those with lower ratios.

It could also mean that investors are expecting strong future growth from the company. On the other hand, low P/E ratios may signal that the stock is undervalued or that the company’s performance has been poor.

When examining a company’s P/E ratio, it is also important to compare it to its competitors in the same sector. Companies that have P/E ratios significantly higher or lower than their peers may be worth researching further.

If a company has a significantly higher P/E ratio than its peers, it may be a good idea to investigate why this is so and whether the stock is overvalued or worth investing in. On the other hand, companies with much lower P/E ratios than their competitors may be undervalued and a good investment opportunity.

Overall, examining the P/E ratio can be an important step when picking stocks for the long-term. By analyzing this metric, you can gain insight into a company’s growth potential and relative value compared to its competitors.

Watch for Fluctuating Earnings

When it comes to picking stocks for long-term investments, one important factor to watch for is fluctuating earnings. It’s important to understand the history of a company’s earnings, which can give insight into whether or not the stock has potential for growth.

If a company’s earnings have been consistently increasing over time, this is a good sign that it is a good long-term investment. On the other hand, if a company’s earnings are erratic or have been decreasing in recent quarters, this could be a sign that the stock isn’t a good fit for long-term investments.

When looking at a company’s earnings, it’s also important to consider the other factors affecting the stock such as its debt and market capitalization.

Additionally, watch for any signs of financial instability such as changes in leadership or drastic reductions in staff. All these elements should be taken into account when evaluating a company’s prospects for long-term investments.

By watching for fluctuating earnings, investors can gain an understanding of how successful the stock may be over the long-term. Although past performance does not guarantee future success, tracking a company’s financials can provide insight into its current and potential future value.

While there are many other factors to consider when selecting stocks for long-term investments, watching for fluctuating earnings is an important step in the process.

Avoid Value Traps

When investing in stocks, it is important to avoid falling into what are known as value traps. Value traps are stocks that may appear to be undervalued, but have underlying issues that make them poor investments. To avoid value traps, investors should always research stocks thoroughly before investing.

When researching a stock, investors should look at the company’s financials. This includes reviewing the company’s balance sheet, income statement, and cash flow statement.

Investors should also look at the company’s competitive position in its market, as well as how well it is managing its operations. If a company has declining revenues and profits, or has large amounts of debt that it can’t pay off, then it is probably not a good investment.

Additionally, investors should pay attention to the company’s management team and their track record. Good management teams can often turn around failing companies, while bad management teams can lead to further decline. Investors should also watch for any red flags, such as accounting fraud or insider trading.

Finally, investors should look for stocks with high potential upside. Companies with good fundamentals and solid competitive positions may be undervalued due to short-term market trends, giving investors an opportunity to buy low and reap the rewards when the market turns around.

In conclusion, it is important for investors to avoid value traps when investing in stocks. By doing thorough research and looking for signs of good management and potential upside, investors can maximize their chances of successful long-term investments.

Analyze Economic Indicators

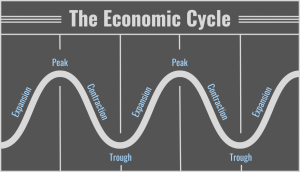

When it comes to investing for the long term, one of the most important factors to consider is economic indicators. These indicators can provide you with valuable insight into the overall health and future prospects of the companies you’re considering investing in.

To get started, research economic trends in your target markets. Understand how these trends may affect the potential return on investment of any stocks you’re considering. Pay special attention to indicators such as gross domestic product (GDP) growth, inflation, employment, interest rates, balance of payments, and consumer confidence.

You should also look at other market-specific indicators such as sector growth and volatility, price-to-earnings (P/E) ratios, and sentiment readings among professional traders.

By understanding the relationship between these factors and stock performance, you can more accurately predict whether a particular stock will be a good investment over the long-term.

It’s also important to keep an eye on global economic trends, especially those that could have an impact on the markets you’re interested in. For instance, watch for news about changes in international trade agreements or currency movements that might influence the stocks you’re tracking.

Finally, consider the impact of political events and public policy decisions on the markets. Knowing how governmental actions can influence stock prices can help you make more informed investment decisions.

Analyzing economic indicators is a critical part of successful long-term investing. By doing your research and being aware of current trends and conditions, you can make more informed decisions and increase your chances of achieving good returns.

Understanding Economic Conditions

When assessing economic conditions, there are several factors to consider. For example, you should look at the overall economic growth of a country or region. This can be done by examining various indicators such as GDP growth, employment figures, inflation rates according to the types of inflation, and balance of payments.

Additionally, it’s important to take into account geopolitical factors that may influence economic conditions. These can include government policies, international trade agreements, and political instability in certain countries.

It’s also important to monitor the financial health of individual companies. This can be done by evaluating their income statements, balance sheets, and cash flow statements. Additionally, you should consider any potential risks such as potential litigation, natural disasters, or labor disputes.

Finally, it’s important to stay up-to-date on current events and news related to the stock market. You should pay attention to events such as earnings reports, mergers and acquisitions, and new product launches. Understanding these events can help you make informed decisions about which stocks to buy or sell.

By taking all of these factors into account when assessing economic conditions, you can gain a better understanding of the stock market and make more informed investment decisions.

Dive deeper into mastering long-term stock selection with our comprehensive blog on “How to Pick Stocks for the Long Term?” To further amplify your understanding, we’ve included an insightful video below.

This video breaks down the key principles and strategies, helping you navigate the stock market confidently. Explore the written wisdom and visual guidance hand in hand for a holistic learning experience. Your journey towards informed stock investments starts here!

Conclusion

In conclusion, picking stocks for the long term is an important part of any investor’s portfolio. When selecting stocks, it is important to do your research and thoroughly analyze a company’s financials, management team, and current market conditions.

Additionally, it is important to consider the tax implications of any stock purchase and to create a diversified portfolio in order to minimize risk. With proper research and strategy, investing in stocks for the long-term can be a great way to build wealth.